One of the best ways to save for your retirement is through a 401(k) Plan. Even saving a small amount can help you down the road.

Eligibility

All full-time and part-time associates, interns and temporary associates are eligible to enroll in the Plan. Associates residing in Puerto Rico or any associate performing services in Puerto Rico are not eligible to participate in the Plan.

Your Contributions

Pre-tax and Roth (after-tax contributions) are available.

Employer Matching Contributions

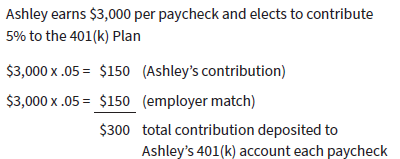

Inovalon provides a generous employer match! Inovalon will match 100% of your first 5% in eligible earnings that you contribute each paycheck. You will be immediately 100% vested in employer matching contributions.

Example of How the Match Works:

Empower Learning Center

Feel inspired about your financial future with expert insights, interactive learning tools, calculators, monthly live webinars and more. Visit the Learning Center here.

For more detailed information, see the Summary Plan Description and the 401(k) Plan Enrollment Guide.

Enrolling and Making Changes to Your 401(k) Account

You must take action and enroll for your contributions, and the employer matching contributions, to begin. To enroll, change or stop your contributions, contact Empower at empowermyretirement.com or at 855-756-4738. If you are a new hire, you may enroll generally after you receive your first paycheck. When you enroll, you’ll need to decide if you want to make pre-tax contributions and/or Roth (after-tax) contributions. A separate election is required to have 401(k) taken from any bonus payments you may receive. You may enroll, change or stop your contributions at any time.

If you enroll or make a change to your current contribution %, your enrollment and/or change will be effective generally within one to two pay checks.