The medical High-Deductible Health Plan (HDHP) gives you more control over your healthcare and spending decisions.

If you enroll in this plan, you pay less per paycheck for your medical coverage. You may also contribute money to a health savings account (HSA) and use the funds to pay out-of-pocket expenses with pre-tax dollars.

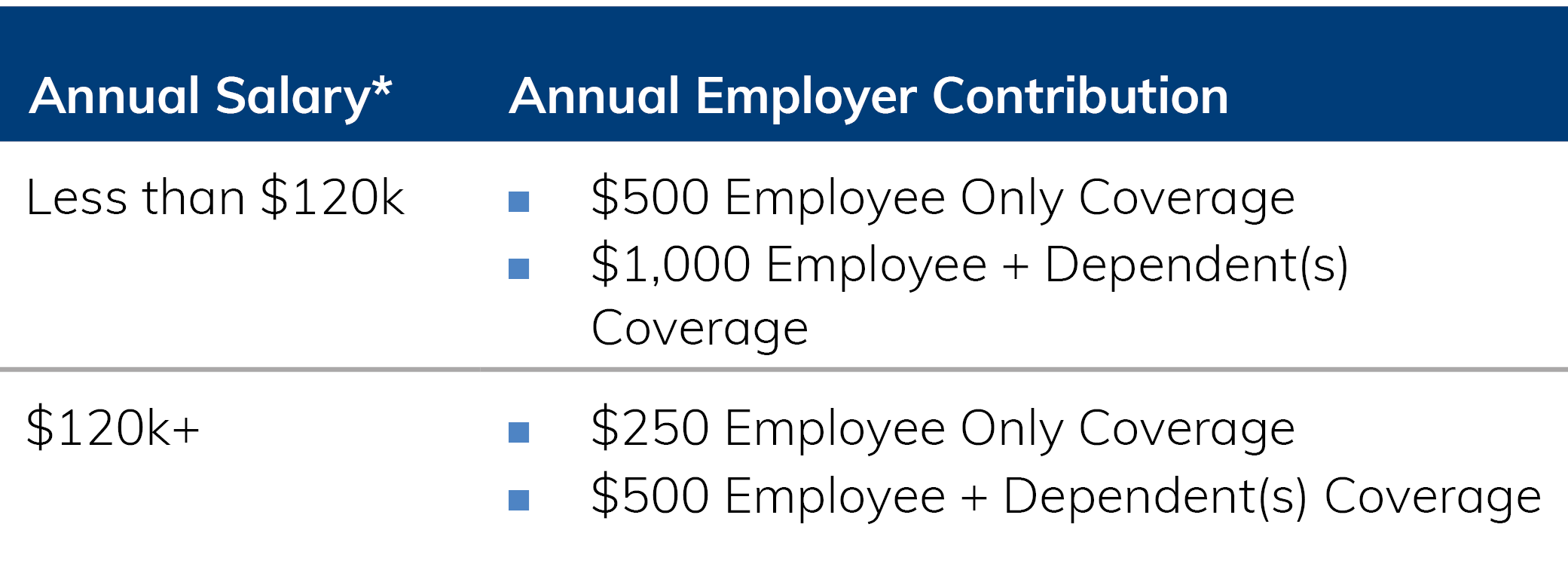

Employer Contribution to Your HSA

Inovalon will make an annual contribution to your health savings account when you enroll in the medical HDHP, even if you don’t contribute. Use these funds for any out-of-pocket medical expenses, including prescription, dental, and vision.

The amount is based on your annual salary and level of medical plan coverage. The full amount of the annual employer contribution will be deposited in January of each year for associates who enroll in the medical HDHP during Open Enrollment.

2025 IRS HSA Maximum Contributions

The IRS does limit the amount that you may contribute to an HSA each year. Contribution limits are based on your medical plan tier and your age in 2024:

- Employee only coverage: $4,300

- Employee + dependent(s): $8,550

- Associates age 55 or older during 2025 may make an additional catch-up contribution of up to $1,000.

Rollovers

For a direct transfer from another HSA to the Allegiance HSA, complete the HSA Transfer to Allegiance Form.

HSA Eligibility

There are some circumstances that may impact your eligibility for an HSA:

- You cannot have both an HSA and a regular Health Care Flexible Spending Account (FSA). You can have an HSA and Health Care FSA if your FSA covers eligible dental and vision expenses only (called a Limited Purpose FSA).

- If you have an HSA, your spouse cannot be enrolled in a Health Care FSA or HRA with his or her employer.

- You cannot be enrolled in Medicare or Medicaid.

- If you have other medical coverage through Tricare/Tricare for Life or have received VA benefits within the past 3 months and do not have a disability rating, you cannot have an HSA.

- If you have coverage under your spouse’s medical plan, you cannot have an HSA.

- You cannot be claimed as a dependent on someone else’s tax return.

Allegiance HSA Resources

Access your health savings account online at www.AskAllegiance.com.

If you are enrolled in the Allegiance HSA, below are some resources to help get you started.

- HSA Quick Start Guide

- Allegiance Advantage Mobile App

- Add or change your HSA beneficiaries

- Health Savings Brokerage Account FAQs

Allegiance Customer Service: 1-877-424-3570 7a.m. – 6p.m. MT, Monday – Friday

Download the Allegiance Advantage Mobile App to: