Basic Life Insurance

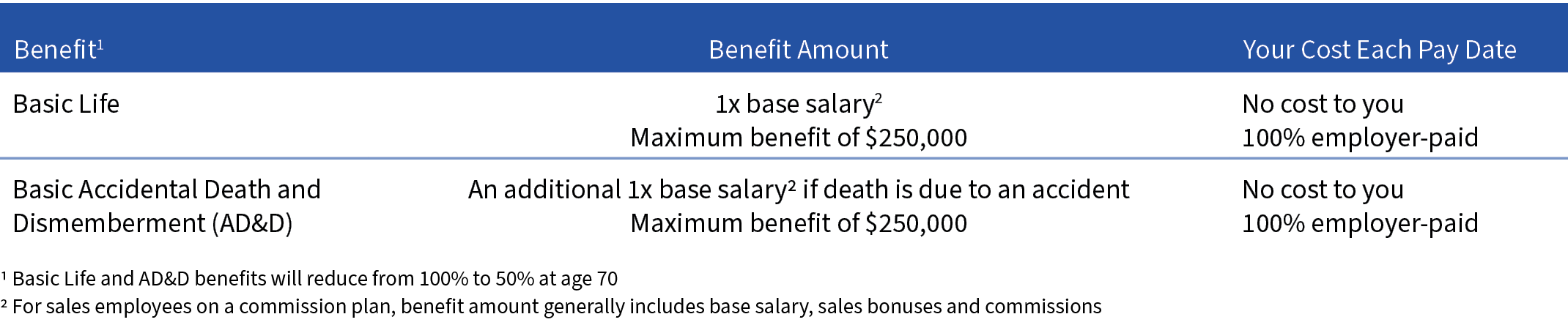

Inovalon provides Basic Life and Accidental Death & Dismemberment (AD&D) insurance through Prudential to eligible employees at no cost.

For more detailed information, see the Summary Plan Description.

Beneficiary Designation

You will need to designate at least one beneficiary for your life insurance(s). Your beneficiary is the spouse, parent, guardian of your child(ren), trust, etc. that will receive the money from the insurance company in the event of your death. You may designate or change your life insurance beneficiary on the benefits enrollment website at www.enroll.apbenefitadvisors.com.

Voluntary Life Insurance

You can purchase Voluntary Term Life Insurance for you and your dependents through Prudential.