What is an HSA?

The Cigna Choice Fund OAP medical plan is a high deductible health plan (HDHP) that offers a health savings account (HSA) component. An HSA is a type of savings account that lets you set aside money on a pre-tax basis through automatic payroll deductions. The money you set aside can then be used to pay for your qualified healthcare expenses.

Some of the advantages of an HSA are:

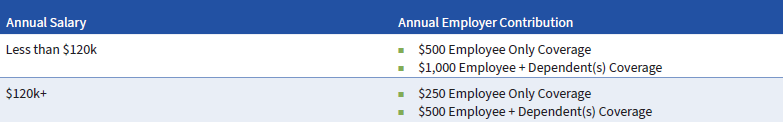

Employer contribution to your HSA

If you enroll in the Cigna Choice Fund OAP with HSA, Inovalon will contribute the amount outlined below to your HSA. The amount is based on your annual salary and level of HSA medical plan coverage. If you enroll in the HSA medical plan after January 1, the employer contribution will automatically be deposited to your HSA by the end of the month following the month in which your medical plan coverage becomes effective. For example, if your medical plan coverage is effective April 1, the employer contribution will be deposited by May 31. If you enroll in an HSA medical plan during Open Enrollment, the annual employer contribution will be deposited to your account in January.

HSA Eligible Expenses

You can use your HSA to pay for a variety of healthcare products and services for you and your dependents. The IRS determines which expenses are eligible for reimbursement. Examples include medical plan deductibles and coinsurance, dental care, over-the-counter drugs (with a prescription), and contact lenses. For a complete list, visit irs.gov and search for Publication 502.

*If you enroll in an HSA after January 1, the employer contribution will be prorated based on your medical coverage effective date. For example, if your medical plan coverage is effective April 1, you will receive 67% of the annual employer contribution(8 months of medical coverage/12 months).