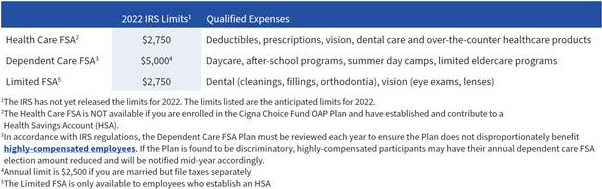

A Flexible Spending Account (FSA) Plan allows you to set aside pre-tax dollars to pay for eligible expenses that you would have otherwise paid for with post-tax dollars.

There are three types of FSAs:

Under all three plans:

For more detailed information, see the Summary Plan Description.

Rollover option for the Health Care FSAs*

If you participate in either the Health Care FSA (HCFSA) or Limited Purpose FSA (LPFSA), you have the option to rollover up to $550 of unused funds into the next plan year. You will forfeit any remaining balance over $550. The rollover amount of $550 does not impact the max election limit of $2,750 for the following plan year (e.g., with the max election limit of $2,750 and the max rollover of $550, a participant will have access to up to $3,300 for the next plan year).

The rollover of unused funds will automatically occur after the end of the claim’s submission deadline for the previous plan year (March 31) and all claims are processed. For example, up to $550 of your unused 2021 funds will be rolled over after March 31, 2022.

You may not rollover unused Dependent Care FSA* funds to the following calendar year.

* In conjunction with special legislation related to COVID, FSA participants may rollover their entire unused 2021 Health Care FSA and/or Dependent Care FSA balances into 2022. The minimum rollover amount is $25. The rollover will automatically occur after March 31, 2022.

Commuter Benefits

Transit and parking benefits allow you to pay for your work-related monthly commuting expenses, such as public transit, vanpooling, and parking fees, using pre-tax dollars. Unlike a health care or dependent care FSA, you can enroll, change or stop your parking or transit contributions at any time.

The IRS sets the monthly maximum that may be deducted before taxes (pre-tax). Currently, the monthly maximum pre-tax transit limit is $270. The monthly maximum pre-tax parking limit is $270. To enroll, log into the benefits website at www.AssuredPartners.lh1ondemand.com or call the Inovalon Employee Benefits Line at 888.896.8031.