A Flexible Spending Account (FSA) Plan allows you to set aside pre-tax dollars to pay for eligible expenses that you would have otherwise paid for with post-tax dollars.

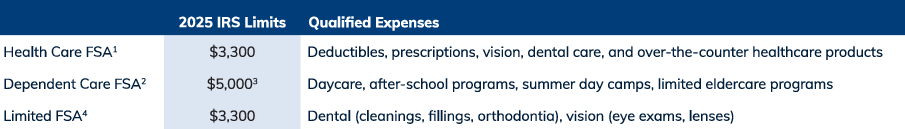

There are three types of FSAs:

- The Health Care FSA is NOT available if you are enrolled in the High Deductible Health Plan medical plan and have established and contribute to a Health Savings Account (HSA).

- In accordance with IRS regulations, the Dependent Care FSA Plan must be reviewed each year to ensure the Plan does not disproportionately benefit highly-compensated employees. If the Plan is found to be discriminatory, highly-compensated participants may have their annual dependent care FSA election amount reduced and will be notified mid-year accordingly.

- Annual limit is $2,500 if you are married but file taxes separately.

- The Limited FSA is only available to associates who establish an HSA.

Under all three plans:

Visit the FSA portal to view your balance and submit claims for reimbursement.

For more detailed information, see the Summary Plan Description.

Rollover option

for the Health Care FSA

If you participate in the Health Care FSA (or Limited Health Care FSA for HSA participants), you have the option to rollover up to $640 of unused Health Care FSA funds at the end of 2024. You must have a balance of at least $50 to be able to rollover unused funds. The rollover amount of $640 does not impact the maximum election limit of $3,300 for the 2025 plan year (i.e., with the maximum election limit of $3,300 and a rollover amount of $640, a participant will have access to $3,940 for the 2025 year). The rollover of unused funds will occur after the claims submission deadline has passed for the previous plan year (March 31, 2025) and all claims are processed.